Navigate me to:

Fidelity Bloom

Role: Senior UX & UI Systems Designer

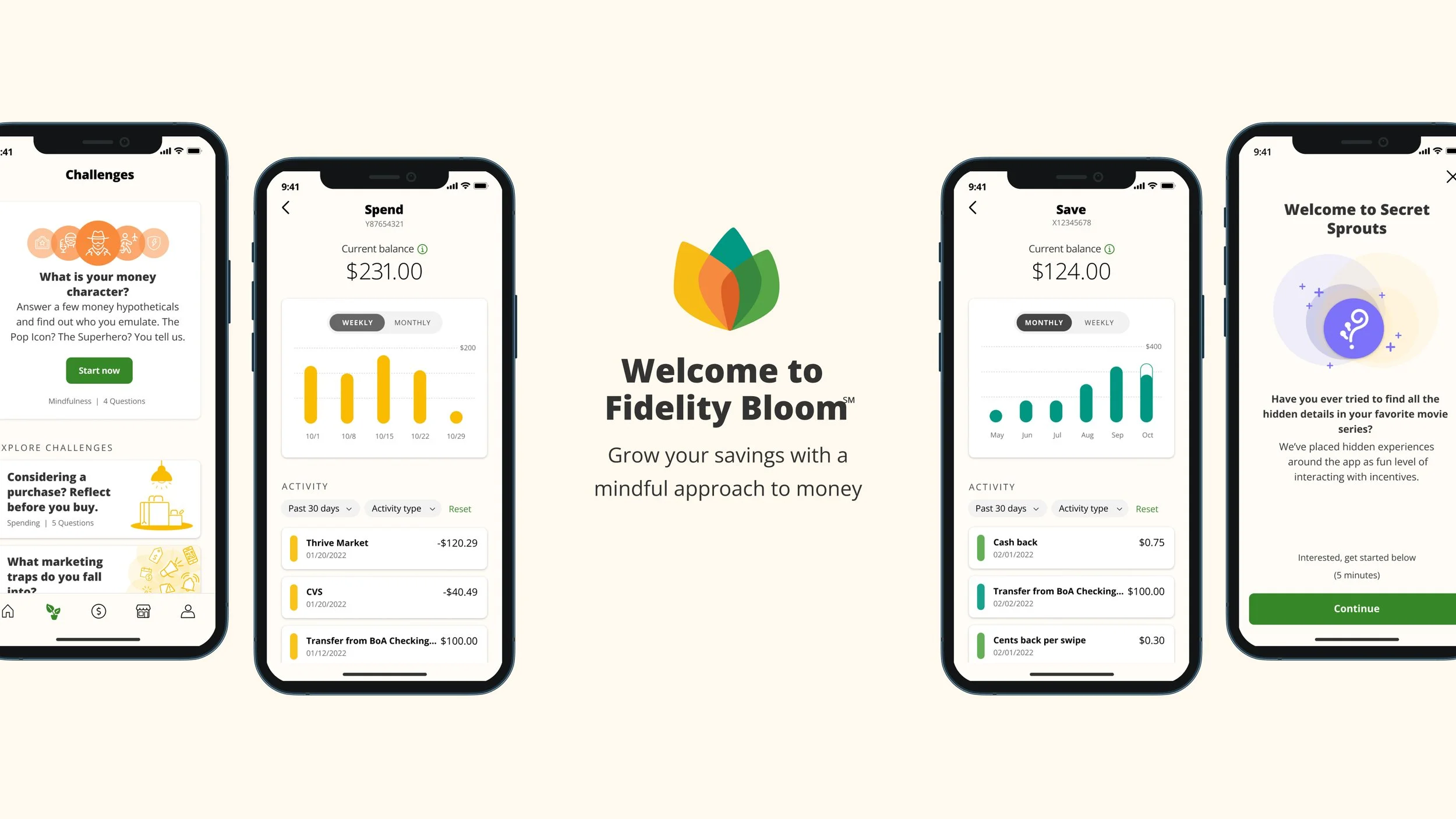

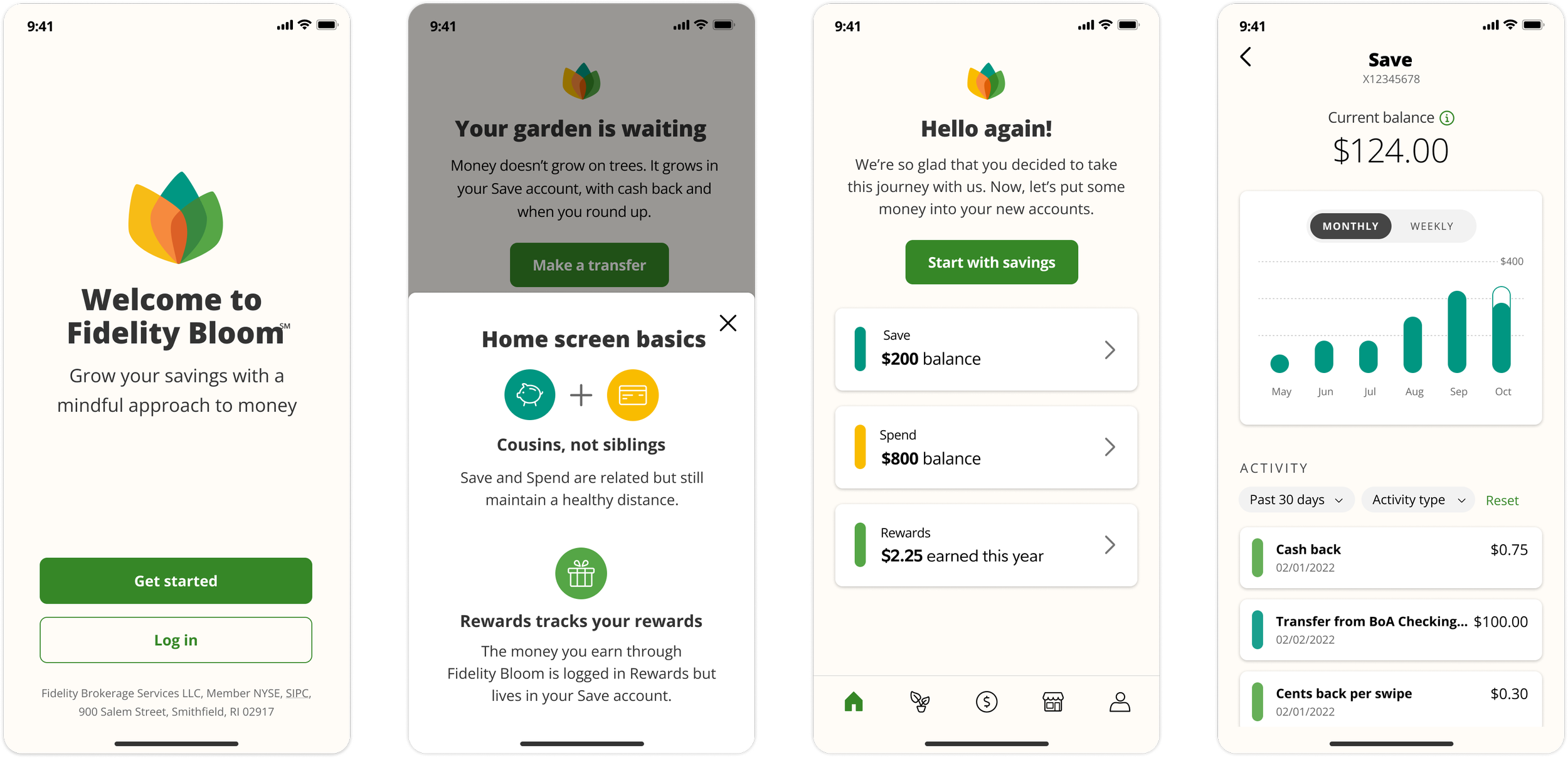

As part of a full-stack design team at Fidelity Investments, I played a key role in launching Fidelity Bloom, a mobile banking app rooted in behavioral science to help users build healthier financial habits. Within an Innovation Accelerator Go-To-Market team, I helped design and validate the proof of concept through user-centered research and iterative testing, while collaborating closely with developers, business teams, and stakeholders to ensure smooth delivery. I also explored innovative concepts through internal hackathons, pushing the boundaries of what Bloom could become.

While the app was eventually discontinued, I remain proud of the foundational design work that contributed to its successful launch and early adoption.

Defining the Problem

Bloom’s target demographic isn’t struggling financially but feels like their money keeps slipping away through small, impulsive purchases. Despite trying budgeting tools, they still feel out of control, stressed, and unsure where to start. They want to save more and spend smarter but lack the clarity, confidence, and guidance to make lasting change.

I want to save more money, but most months I end up spending more than I would like because all the little purchases add up, and it seems like my money just disappears into thin air.

I feel frustrated I can’t successfully save. I know what I should do in theory, but it's hard to figure out the right trade-offs relevant to my life.

I don’t know where to start and I have little confidence I can figure out how to do this on my own.

Bloom’s Target

Demographic + Persona

Charlie, 29, is a compassionate Physician Assistant in Chicago who enjoys exploring the city and staying active. They experience anxiety and stress over money and spending, despite trying various tools to improve. Charlie desires to save more and address their spending habits while continuing their mental health advocacy and volunteer work.

Research Background

Fidelity’s 2022 Money Mindset study found that many young adults (18–44) feel anxious and avoidant about money, with 59% cringing at checking their balance and 65% feeling overwhelmed by saving. Emotional barriers like FOMO, guilt, and the belief that saving requires sacrificing happiness revealed a clear need for a non-judgmental, emotionally supportive product that makes saving feel attainable and aligned with everyday life.

High-level Demographic Mindset

Feel like they don’t have

control over money and spending, which creates anxiety, stress, guilt, shame.

Desires to save more money effectively and make a conscious effort to address various spending habits.

Has tried different tools and techniques to reduce spend, but haven’t found anything that works for them.

UX Solutions

As part of the Full-Stack Design Team within the Innovation Accelerator Go-To-Market team, I contributed to developing Fidelity Bloom, addressing emotional pain points identified in Fidelity’s 2022 Money Mindset study and creating a solution that empowers users to build healthy financial habits. Below are UX highlights that showcase the UX Solution work.

Note: The screens below were created during an early stage.

-

Iterative Research + Behavioral Science Check-ins

To develop the Fidelity Bloom app, we employed an iterative research and usability testing approach, conducting multiple rounds of concept testing and user feedback sessions to refine the product. Each iteration helped us identify key pain points and fine-tune features to align with user needs.

Additionally, we checked in weekly with a dedicated team of behavioral scientists to ensure the app stayed grounded in financial behavioral science principles, allowing us to create a solution that not only addressed financial anxiety but also motivated users to build long-lasting financial habits.

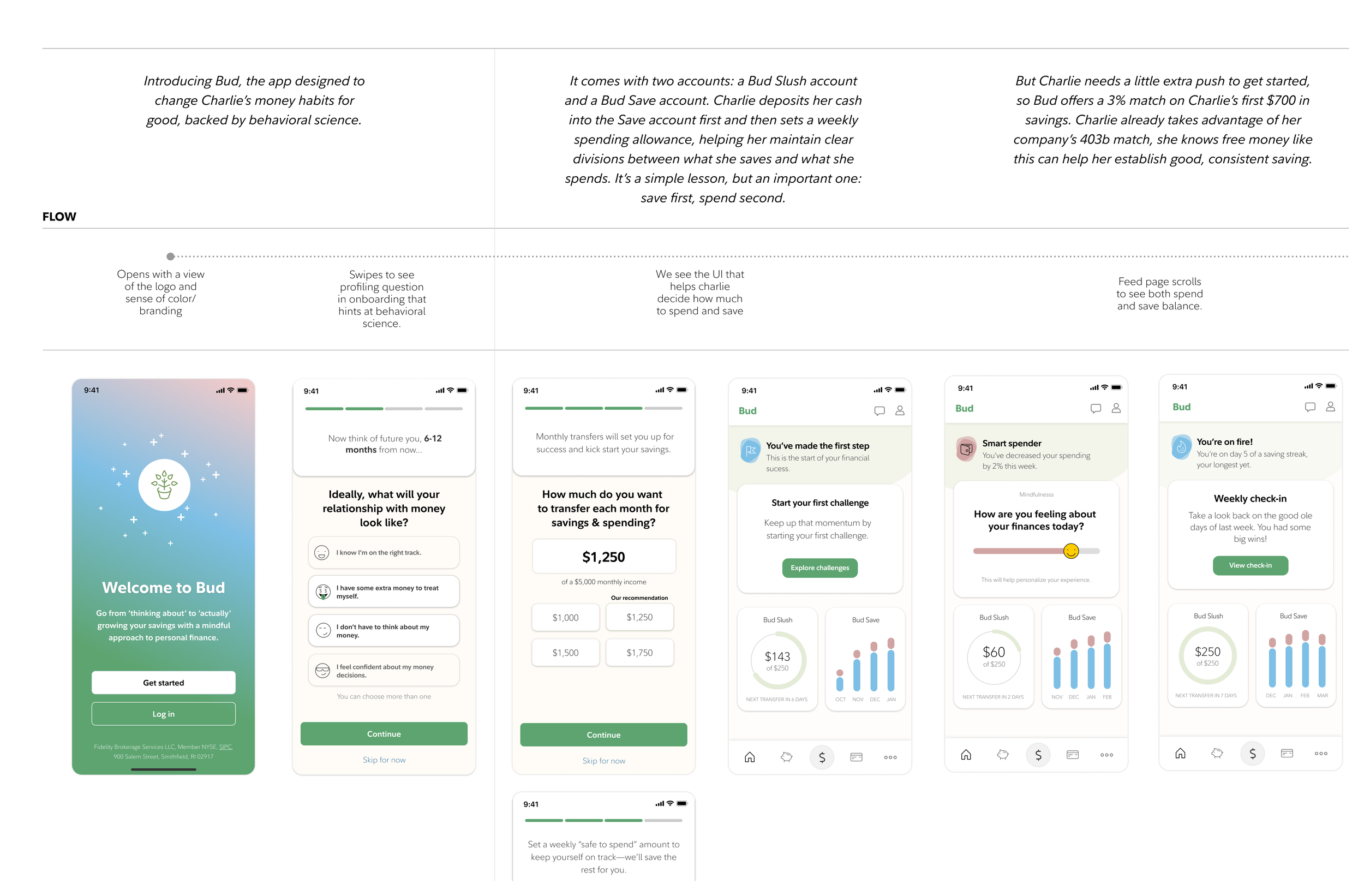

A first pass at the MVP narrative was developed from this process, which you can see a cropped version of below.Note: The screens below were created by me while the work was under NDA and does not reflect app’s design.

Behavioral Design Approach

Fidelity Bloom was designed to tackle users demographic mindsets head-on. Within our check-ins with Behavioral Science we co-created a set of principals for Fidelity Bloom. These offerings were designed to:

Reduce financial anxiety by introducing small, rewarding money habits

Encourage mindful spending without requiring drastic lifestyle changes

Motivate saving through positive reinforcement and gamified challenges

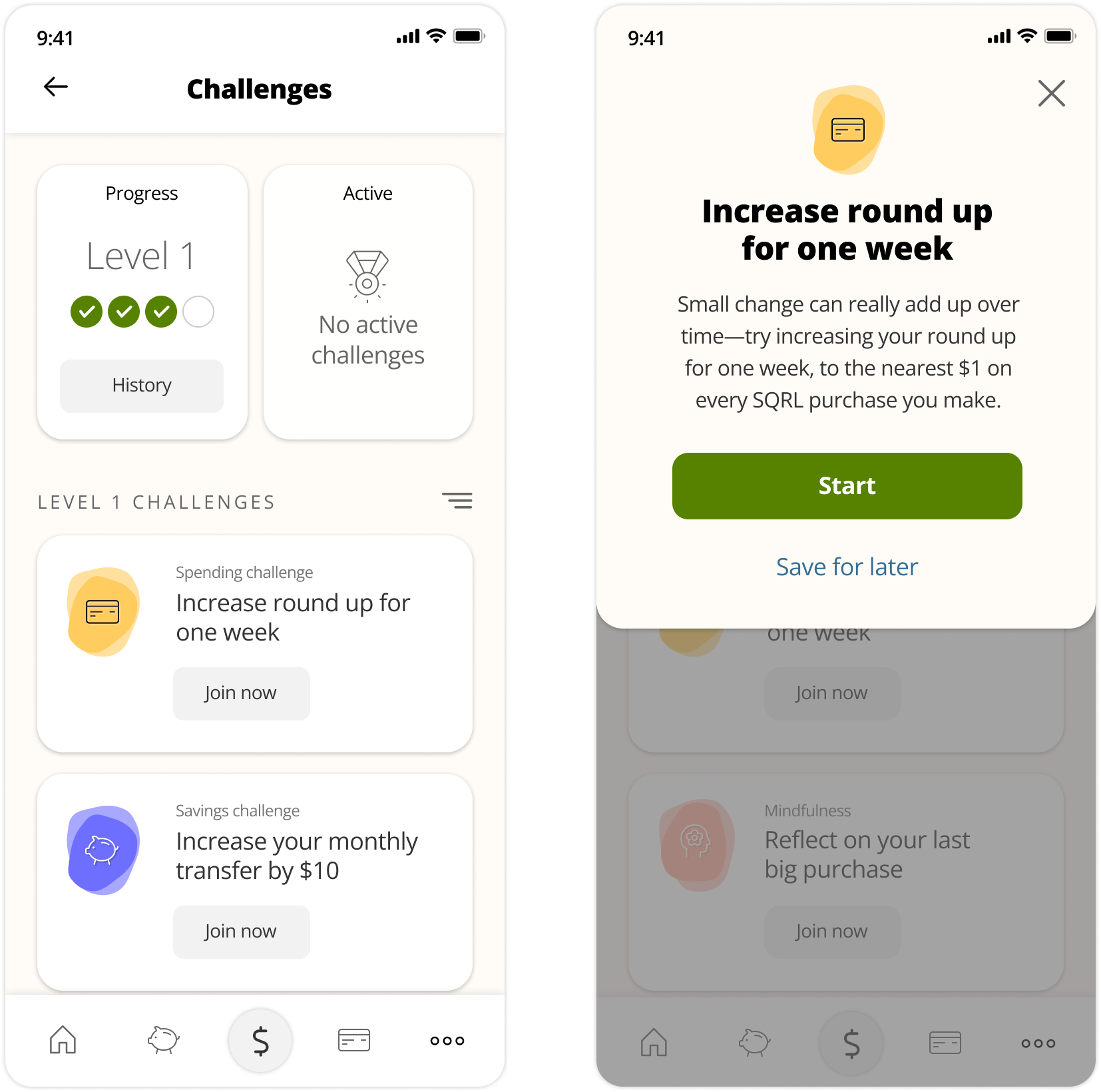

Note: The screens below reflect the app’s design.

-

Saving + Shopping

To further support habit-building and drive user engagement, Fidelity Bloom integrates a shopping portal directly within the app, allowing users to earn up to 25% cash back when purchasing from over 1,100 participating retailers.

-

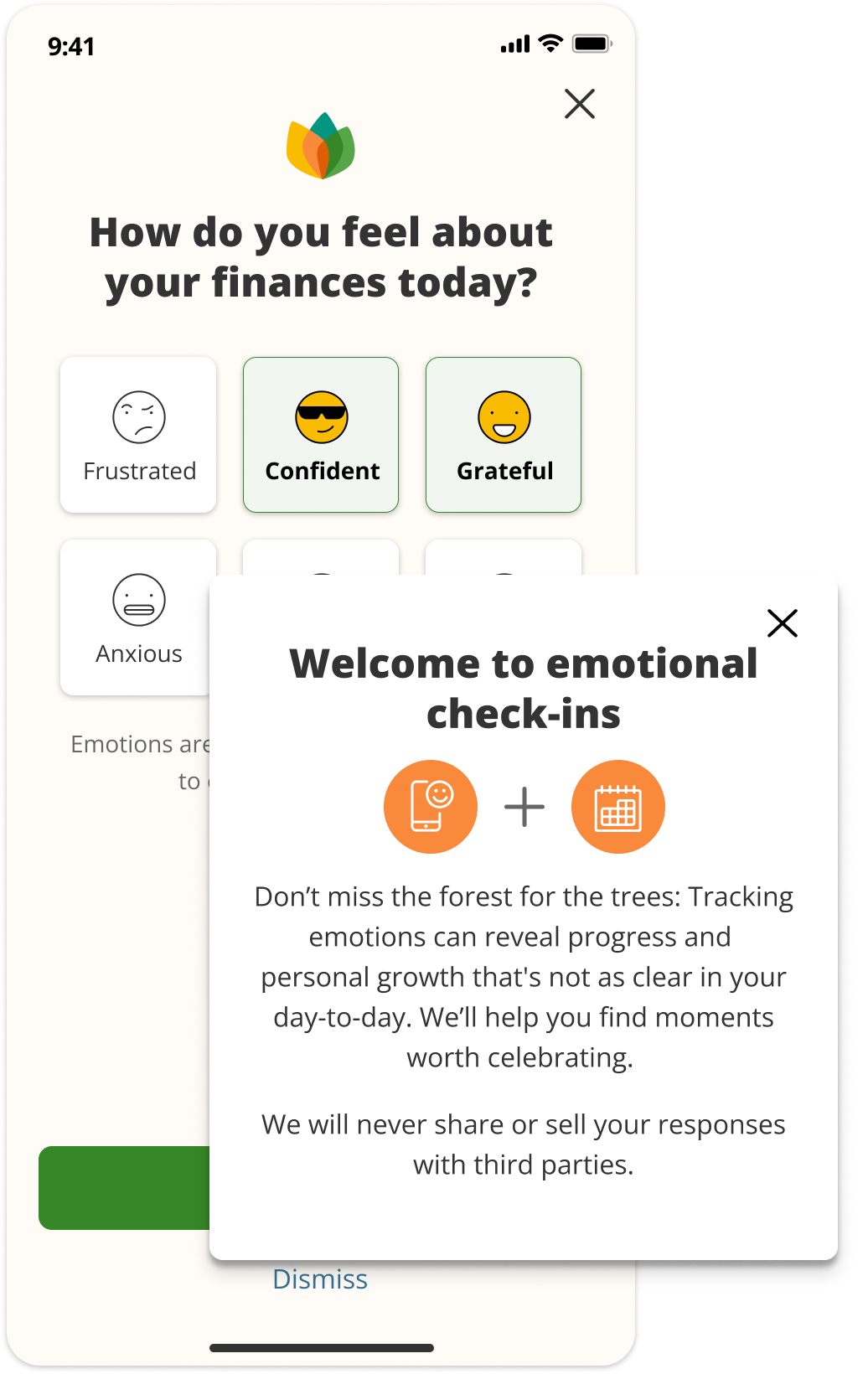

Emotional Check-ins

Using frequent emotional check-ins and Positive reinforcement and rewards to build motivation and reduce stress.

-

Financial Based Rewards

Automatic saving features help reduce effort with tools like round-ups, recurring transfers, and instant rewards. These include benefits such as cash back, savings matches, and micro-deposits, which may start at amounts like $0.10 for each purchase.

-

Challenges, Nudges, + Gamification

Fidelity Bloom included a friendly, gamified interface with small challenges, quizzes, and nudges that fit users’ existing lifestyles. Challenges like “No-Spend Days” or “Move $10 to Savings,” were designed to feel achievable and build momentum. These interactions applied behavioral science principles—positive reinforcement, habit stacking, and emotional reframing—to reduce financial anxiety and make saving feel rewarding and sustainable.

What I learned

I strengthened my skills in creating clean, developer-ready handoff files with clear flows and annotations to streamline collaboration. I partnered closely with developers to identify and resolve blockers, which helped keep delivery on track. I worked cross-functionally on the design and validation of the proof of concept, guided by iterative user research to ensure solutions met real needs. I also explored innovative design thinking through internal hackathons, experimenting with playful, game-like elements to push the product further.

-

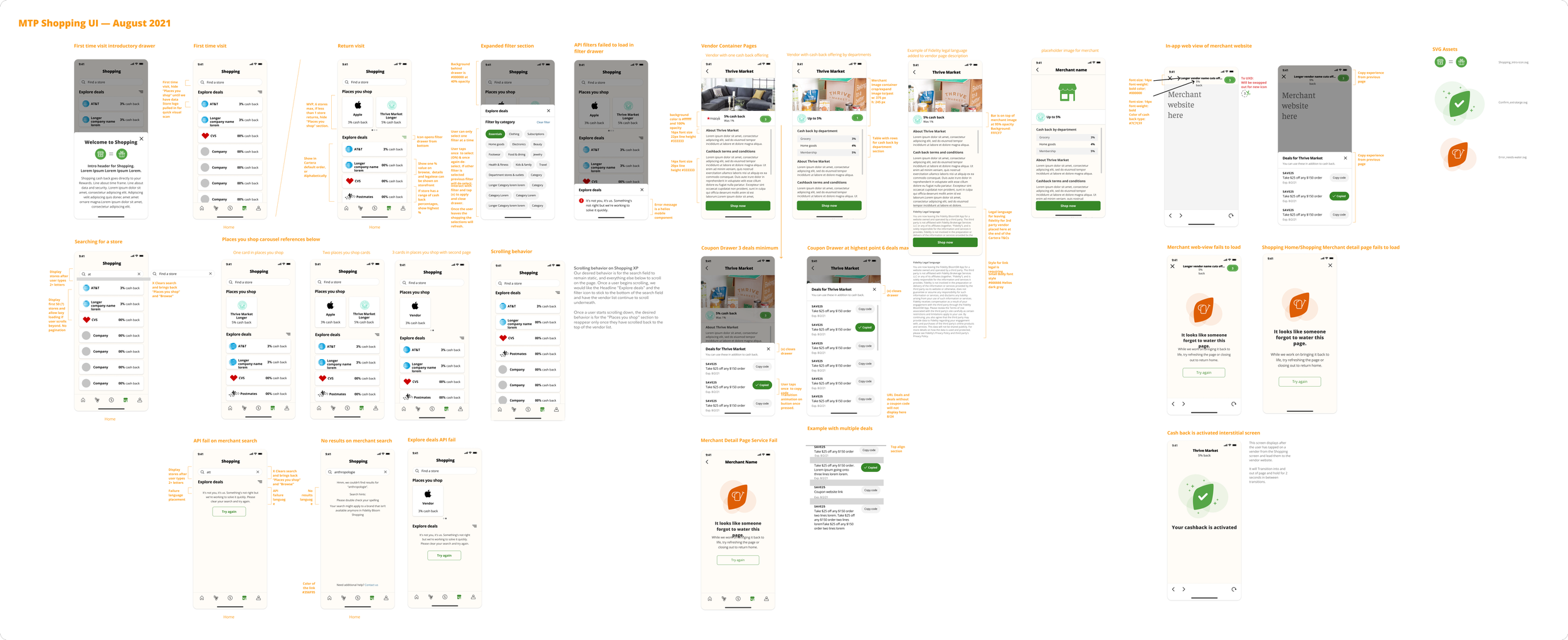

Design-to-Dev Handoff

Our team focused on clean, consistent design handoff files to enhance collaboration with developers and speed up build time. Each screen was organized with clear flows, status markers, interaction notes, and accessibility annotations.

-

Fidelity's Hackathon

I enrolled in Fidelity’s yearly hackathon and created Secret Sprouts. A system of hidden interactions and rewards designed to re-engage customers in Fidelity’s new mobile app, adding a playful layer alongside the core Challenges feature.

-

Lean UX

Guided by iterative user research, our team applied a lean UX approach, learning and adapting quickly to create the MVP app. Weekly sessions with design and behavioral science teams ensured we consistently tested concepts, designs, and functionality with customers to keep the product aligned with real user needs.

-

Note: The screen above was created by me for Design-to-Dev Handoff.

RIP, Fidelity Bloom

Fidelity discontinued Fidelity Bloom in early 2025. While I’m no longer with the company and don’t have full insight into the reasons behind the decision, I’ve gathered relevant reviews and user feedback using Google AI to provide background on to what users thought about the app.

”According to YouTube reviewers, Fidelity Bloom was seen as a decent option for beginners but was criticized for its "clunky" app and rewards that were not "significant”.”

-

Confusing account structure

Bloom’s split “Spend” and “Save” accounts made everyday spending cumbersome and confused users about long-term investing, undermining growth and compound interest.

-

Bloated Features

Bloom’s shopping portal, added little value and created a cluttered, overwhelming experience for users. The app's "challenges" were criticized as being too simplistic and not providing any real educational value to the user.

-

Poor technical performance

Users reported slow transactions, login issues, and unreliable biometric authentication, making Bloom frustrating for everyday financial management.